An effective LOS needs to be tightly integrated and work hand in glove with customer relationship management (CRM) tools to quickly send requests and process responses. Underwriting is a data-intensive process. In underwriting, a lender weighs the physical and financial risks associated with a loan using source documents provided by a borrower along with public and proprietary property data to make a final determination whether to approve or reject an application. In an LOS, this also happens electronically once the system determines all preapproval conditions have been met. With source documents and an independent property appraisal in the LOS, Lisa and Frank’s mortgage application moves on to underwriting. This could have taken up to 72 hours if their lender did not have an online LOS platform. Lisa and Frank upload the requested documents through the LOS portal and receive a loan estimate almost immediately. Preapproval will also require a hard credit check so their lender can get their credit score, and see how much other debt they may have.ĭocuments required for preapproval typically include:

During preapproval, Lisa and Frank will need to provide source documents, such as bank statements and pay stubs, to prove their income. Prequalification relies solely on information provided in the application preapproval involves proof that the application information provided is accurate.

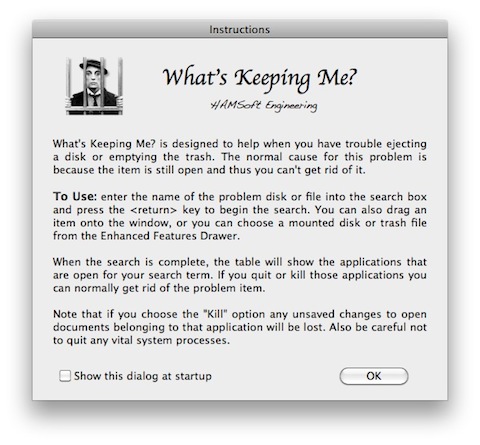

WHATS KEEPING ME FROM GETTING MULTIPLE MORTGAGE LONS SOFTWARE

They sign a purchase contract and the LOS software kicks off the preapproval processes by ordering an appraisal.Īlthough some lenders use the terms prequalification and preapproval interchangeably, there is a difference. Lisa and Frank are excited to have been prequalified. In a premier LOS, this transition from POS to PPE is seamless, allowing the process to quickly advance to the next step. This is a big improvement from the days when loan officers had to meet with every prospect in person and call around to prospective lenders to prequalify a borrower. In other words, the PPE allows Lisa and Frank to quickly and easily find a loan they can afford. This letter, generated by the LOS, lets them know their purchase can proceed, if the information they provided can be confirmed and the property they are interested in passes muster as collateral. Lisa and Frank select their preferred loan product and terms and receive an automated prequalification letter. The PPE analyzes loan options and pricing currently available to borrowers with similar income, savings and credit and presents Lisa and Frank with a variety of loan options. In this case, it is, and the application passes from the POS to another module, known as the Product and Pricing Engine (PPE). Step 2: PrequalificationĪfter the application is complete, the LOS checks to see whether the income, savings and credit rating Lisa and Frank reported are sufficient to warrant additional consideration for the amount they want to borrow.

The LOS sends an automatic notification to a loan officer, who helps Lisa and Frank provide the missing information. As is often the case, the homebuyers left a few important fields blank. The LOS reviews the application and analyzes it for completeness. Lisa and Frank complete the form to the best of their ability and submit it through the portal. They enter the LOS through a portal known as a Point-of-Sale or (POS). Lisa and Frank apply for a mortgage online. Let’s follow Lisa and Frank through their homebuying journey to see an LOS in action. This article examines the characteristics of an effective LOS by using avatars Lisa and Frank, who are buying a new home, to illustrate the different steps in the process. To qualify clients and direct them to loan fulfillment.Īn effective LOS removes friction from the mortgage origination process and facilitates the timely progression of loans from application through post-closing. To manage the steps in the loan origination journey.Ģ. A Mortgage Loan Origination System (LOS) is a digital tool for managing the mortgage lending process from application submission to post-closing.

0 kommentar(er)

0 kommentar(er)